DISCLAIMER:

This article does not offer any financial or investment advice, and all trading and other market activities are conducted at your own risk. Please make sure that spread betting is legal in the location you will be trading from.

These days, increasing numbers of people are speculating on the forex, or foreign exchange, market. However, there is more than one way to speculate on this market.

In some jurisdictions, it’s possible to trade forex through spread betting. This enables traders to potentially benefit whether the market is increasing or decreasing in value.

But is this type of forex trading the right choice? This guide can’t decide for you, but it can offer more information on spread betting, along with some of the pros and cons. With this knowledge, you can make an informed decision based on your own situation.

What is Spread Betting in Forex?

Spread betting is a type of derivative trading, which means you don’t own any underlying asset. Instead, you predict which way you think the asset’s price is going to move.

Justin Grossbard, co-founder of Spread-Bet.co.uk, offers some more information:

“If we’re talking about forex spread betting specifically, this means the asset is a foreign exchange pair”, Justin said. “This might be the EUR/USD, the USD/CHF, or something else.”

“The relative values of these currencies can go up and down multiple times across the trading day, and traders are hoping to take advantage of this. However, there are always risks – predictions can go wrong”.

How Does Forex Spread Betting Work?

Forex spread betting works like this.

- Select Your Instrument

You select the instrument you want to place a spread bet on. For example, the EUR/USD listed above, or something different, like the AUD/GBP.

- Decide on Movement Direction

Then you decide which way you think the price will move. In other words, do you think the price will rise or fall?

- Choose Your Leverage

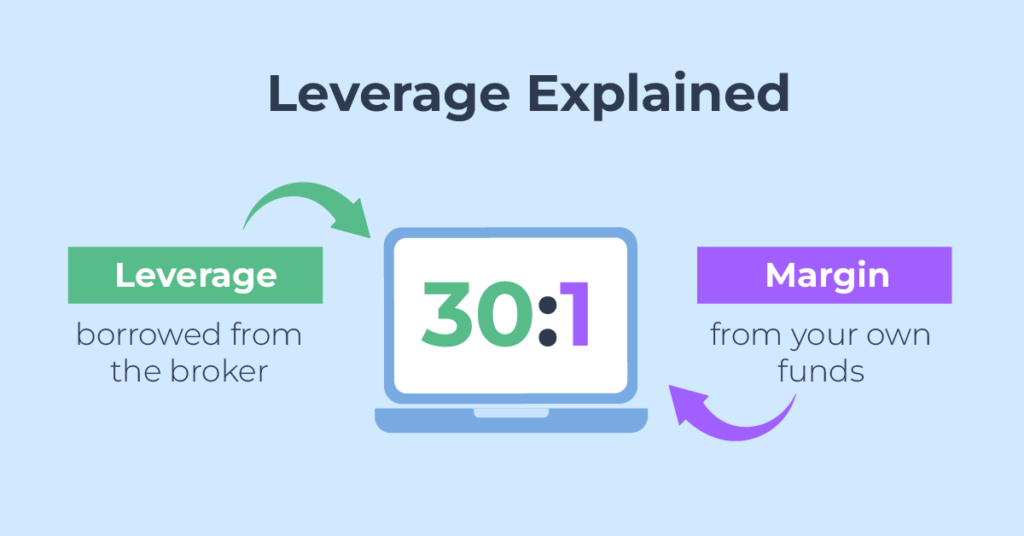

You will always be using leverage when you spread bet. This is the amount of money you would borrow from the broker to control a larger position. Leverage on a spread bet can be up to 30:1, which means you’d borrow £30 for every £1 of your own you put forward.

In the 30:1 example, the £1 is your margin. This is the minimum deposit required to open your spread bet. Higher leverage rates increase both the potential profit and the risk involved. Be conservative with leverage.

- Pick Your Bet Size

Next, you choose the amount you want to stake per pip. A pip is the smallest unit of value for a currency pair, and it is represented at the fourth decimal place on most currency pairs. You will need to choose how much each pip will be worth. For example, you might choose to wager £5 for each pip.

Like with leverage, a higher bet size equals a higher level of risk.

- Apply Risk Management Parameters

There are steps you can take to reduce your risk. One is to apply a stop-loss, which means the spread bet will automatically close if your losses reach a certain level. The stop-loss can’t prevent you from losing money if your prediction is wrong, but it can limit these losses. In other words, a stop-loss is a necessary risk management measure.

- Open, Monitor and Close Your Position

The spread bet is now set up. Now you can open your position, monitor it, and then close the position to finish the bet. It’s the difference between the opening and closing value that determines your profit or loss.

Is Forex Spread Betting For You? Pros and Cons

Spread betting won’t be for everyone, and there are certainly both pros and cons to this type of trading. Learn more about this below.

Potential Spread Betting Advantages

Many traders choose spread betting for the following reasons.

Profits may be tax-free in some jurisdictions

Perhaps the biggest benefit of forex spread betting is that the profits may be tax-free. For instance, the HMRC in the U.K. defines spread betting as a form of gambling rather than investment, so there is no capital gains tax to pay on any profits you make.

What’s more, as spread bets are forex derivatives, you won’t need to pay any stamp duty. This is because no assets are changing hands.

Potential profits in varying market conditions

You can potentially profit whether the market is moving up or down, as long as you make the right prediction. This is not possible with traditional buy-and-hold investments in foreign currency. With this type of investment, you can only profit if the price increases.

The opportunity to increase position sizes with leverage

Leverage means you can control a position up to 30x greater than your capital reserves would otherwise allow. You just need to make sure your account balance is enough to service the position.

The Risks of Spread Betting

There are risks to spread betting, however. It’s important to be aware of these potential downsides.

Leverage magnifies the risk of spread betting

There is a downside to leverage. Higher leverage also increases the risk of your trade. Always be careful when using leverage, as one bad trade can wipe out your account balance.

Forex spread betting is not available everywhere

Many jurisdictions do not permit spread betting on forex pairs. In these locations, you will be prohibited from placing spread bets.

Even experienced traders make mistakes

Spread betting is never an exact science. Even the most experienced traders make mistakes, so the risk never goes away, even when you have been trading for a long time.

Making Your Mind Up – Is Forex Spread Betting Right for You?

This is a personal decision. What’s right for one type of trader won’t always be right for another. To find out for yourself, it’s a good idea to sign up for a free demo account with a broker. This way, there is no danger, as you are not risking any real money.

Using a demo account will give you a better idea of whether spread betting can work for you, or if you’d prefer to try another way to speculate on the markets.

DISCLAIMER:

Spread betting is a high-risk activity. This article is for informational purposes only, and does not constitute financial or investment advice. All market activity is conducted at your own risk.

Many jurisdictions, including the United States, do not permit spread betting. It is up to you to make sure that spread betting is legal in your specific jurisdiction.